Anion Exchange Membrane Fuel Cells in 2025: Unleashing Next-Gen Clean Energy with Rapid Market Expansion. Explore the Breakthroughs, Key Players, and Forecasts Shaping the Future of AEMFC Technology.

- Executive Summary: 2025 Market Highlights and Key Takeaways

- Technology Overview: Fundamentals and Innovations in AEMFCs

- Current Market Size and 2025 Valuation

- Growth Drivers: Policy, Sustainability, and Industrial Demand

- Competitive Landscape: Leading Companies and Strategic Moves

- Emerging Applications: Transportation, Stationary Power, and Beyond

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Barriers: Technical, Economic, and Regulatory Hurdles

- Market Forecast 2025–2030: CAGR, Revenue Projections, and Scenario Analysis

- Future Outlook: R&D Trends, Commercialization Pathways, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Highlights and Key Takeaways

The global market for Anion Exchange Membrane Fuel Cells (AEMFCs) is entering a pivotal phase in 2025, marked by accelerated research, early-stage commercialization, and strategic investments from both established players and innovative startups. AEMFCs, which utilize hydroxide-conducting membranes, are increasingly recognized for their potential to enable cost-effective, platinum-free fuel cell systems, addressing key challenges in the hydrogen economy.

In 2025, leading membrane manufacturers such as 3M and DuPont are intensifying their focus on advanced polymer chemistries to improve membrane durability and ionic conductivity. These efforts are complemented by the activities of specialized companies like Fuel Cell Store, which supplies a range of AEM materials and components to research institutions and pilot projects worldwide. The entry of Umicore into the AEMFC catalyst market, leveraging its expertise in non-precious metal catalysts, is also noteworthy, as it signals a shift toward more sustainable and scalable fuel cell technologies.

Automotive and heavy-duty transport sectors are showing growing interest in AEMFCs due to their potential for lower system costs and improved fuel flexibility. Companies such as Toyota Motor Corporation and Honda Motor Co., Ltd. are actively monitoring AEMFC advancements, with pilot programs and collaborative research underway to assess their viability for next-generation vehicles. Meanwhile, European initiatives, supported by organizations like Fuel Cells and Hydrogen Joint Undertaking (FCH JU), are funding demonstration projects to validate AEMFC performance in stationary and portable power applications.

Despite these advances, the AEMFC market in 2025 remains at a pre-commercial or early-commercial stage. Key technical challenges—such as membrane chemical stability, water management, and long-term durability—are the focus of ongoing R&D. However, the pace of innovation is accelerating, with several companies targeting commercial-scale deployments within the next three to five years. The outlook for AEMFCs is optimistic, driven by the global push for decarbonization, the need for affordable hydrogen solutions, and the increasing availability of renewable energy.

- Major chemical and materials companies are scaling up AEM production and investing in next-generation membrane technologies.

- Automotive OEMs and energy companies are initiating pilot projects to evaluate AEMFCs in real-world applications.

- Public-private partnerships and government funding, especially in Europe and Asia, are accelerating technology validation and market entry.

- Commercialization timelines are expected to shorten, with early market entries anticipated by 2027–2028.

In summary, 2025 is a year of significant momentum for AEMFCs, with industry leaders and innovators laying the groundwork for broader adoption and commercialization in the near future.

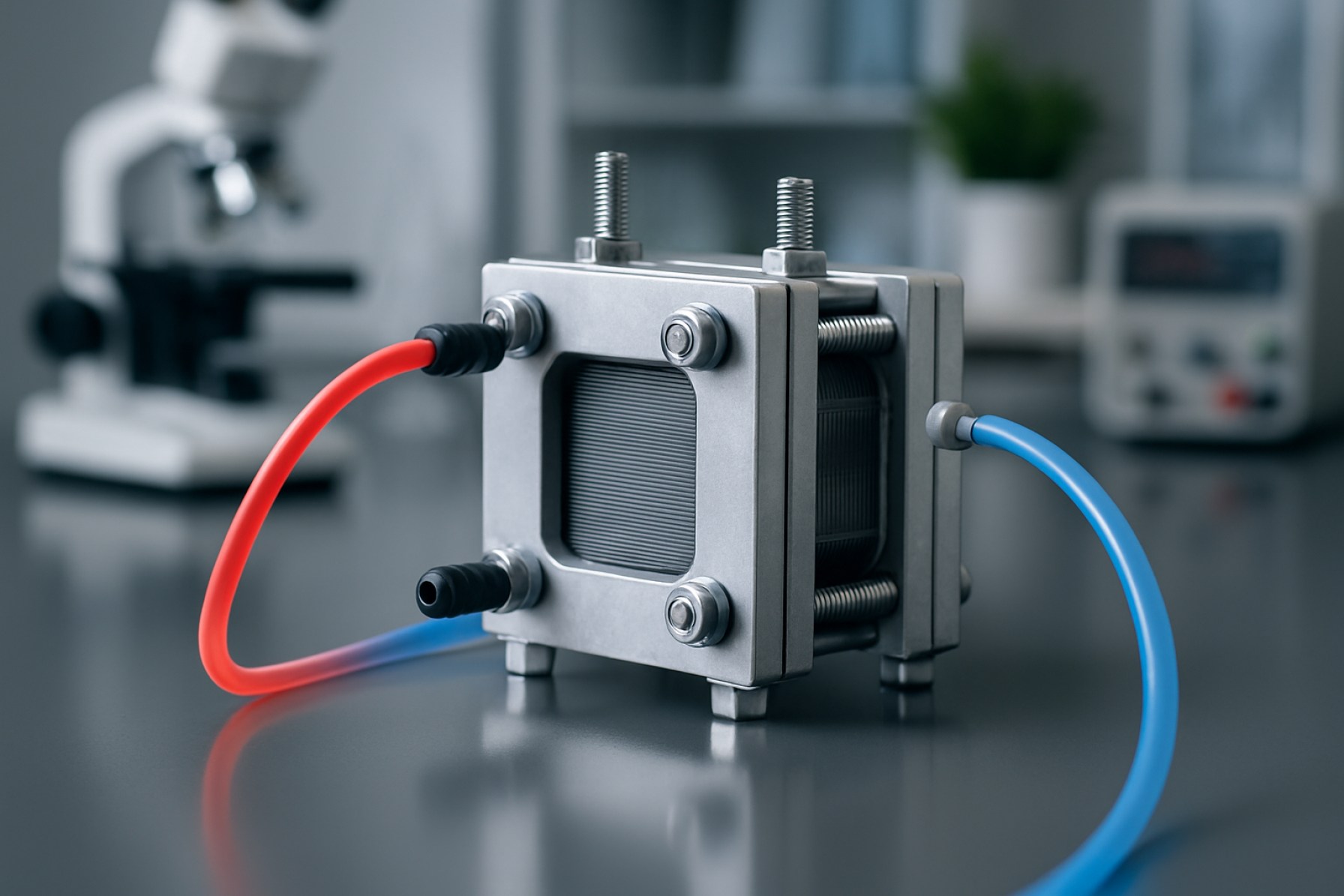

Technology Overview: Fundamentals and Innovations in AEMFCs

Anion Exchange Membrane Fuel Cells (AEMFCs) represent a rapidly advancing class of electrochemical energy conversion devices, distinguished by their use of anion (typically hydroxide ion, OH–) conducting polymer membranes. Unlike the more established Proton Exchange Membrane Fuel Cells (PEMFCs), AEMFCs operate in alkaline environments, enabling the use of non-precious metal catalysts and potentially reducing overall system costs. As of 2025, the technology is transitioning from laboratory-scale demonstrations to early-stage commercial applications, driven by significant material and engineering innovations.

The core of AEMFC technology lies in the development of robust, highly conductive, and chemically stable anion exchange membranes (AEMs). Recent years have seen the emergence of advanced polymer chemistries, such as poly(aryl piperidinium) and poly(phenylene oxide) backbones, which offer improved alkaline stability and ionic conductivity. Companies like 3M and Dow are actively engaged in the development and scaling of next-generation AEM materials, leveraging their expertise in specialty polymers and membrane fabrication.

AEMFCs are particularly attractive for their ability to utilize platinum group metal (PGM)-free catalysts, such as nickel, cobalt, and silver, for both the anode and cathode reactions. This feature addresses one of the major cost barriers in PEMFCs, where platinum remains a critical and expensive component. Umicore, a global leader in catalyst technologies, is investing in the research and production of non-PGM catalysts tailored for alkaline fuel cell environments, aiming to support the commercialization of AEMFC stacks.

System-level innovations are also underway, with companies like Ballard Power Systems and Cummins exploring AEMFC integration for light-duty vehicles, stationary power, and backup energy solutions. These efforts are complemented by collaborative projects with automotive OEMs and energy utilities, targeting improved durability, power density, and operational lifetimes. For instance, Ballard’s ongoing R&D programs focus on optimizing membrane electrode assemblies (MEAs) and stack designs to meet the rigorous demands of commercial deployment.

Looking ahead to the next few years, the outlook for AEMFCs is promising but contingent on overcoming key technical challenges, including membrane longevity, carbonate management, and large-scale manufacturing. Industry consortia and public-private partnerships, such as those coordinated by Fuel Cell and Hydrogen Energy Association, are expected to play a pivotal role in accelerating standardization and market adoption. As material costs decrease and performance metrics improve, AEMFCs are poised to become a competitive alternative in the global fuel cell landscape, particularly for applications where cost and catalyst flexibility are paramount.

Current Market Size and 2025 Valuation

The market for Anion Exchange Membrane Fuel Cells (AEMFCs) is experiencing a period of accelerated development, driven by the global push for decarbonization and the search for alternatives to proton exchange membrane (PEM) technologies. As of 2025, AEMFCs remain a niche but rapidly growing segment within the broader fuel cell industry, with increasing attention from both established players and innovative startups. The unique advantage of AEMFCs—enabling the use of non-precious metal catalysts and operation in alkaline environments—positions them as a promising solution for cost-effective and sustainable hydrogen energy systems.

While the overall fuel cell market is dominated by PEM and solid oxide fuel cells, AEMFCs are gaining traction, particularly in stationary power, backup systems, and emerging mobility applications. Industry leaders such as Chemours and Toyota Motor Corporation have invested in research and pilot projects exploring AEMFCs, with Chemours leveraging its expertise in membrane materials to develop next-generation anion exchange membranes. Meanwhile, companies like Alkegen and Fuel Cell Store are supplying advanced membrane and component solutions to research institutions and early adopters.

In 2025, the global AEMFC market is estimated to be valued in the low hundreds of millions USD, representing a small but significant share of the multi-billion dollar global fuel cell market. Growth rates for AEMFCs are projected to outpace those of more established fuel cell types, with annual growth rates exceeding 20% in some forecasts, as new demonstration projects and pilot deployments come online. The Asia-Pacific region, led by Japan, South Korea, and China, is at the forefront of AEMFC research and commercialization, supported by government initiatives and partnerships with major automotive and chemical companies.

Looking ahead, the next few years are expected to see increased investment in scaling up AEMFC production, improving membrane durability, and reducing system costs. Strategic collaborations between material suppliers, system integrators, and end-users are anticipated to accelerate the transition from laboratory-scale prototypes to commercial products. As the hydrogen economy matures and demand for affordable, high-performance fuel cells grows, AEMFCs are poised to capture a larger share of the market, particularly in applications where cost and catalyst flexibility are critical. Companies such as Chemours, Alkegen, and Fuel Cell Store are expected to play pivotal roles in shaping the market landscape through 2025 and beyond.

Growth Drivers: Policy, Sustainability, and Industrial Demand

The growth trajectory of Anion Exchange Membrane Fuel Cells (AEMFCs) in 2025 and the coming years is shaped by a convergence of policy initiatives, sustainability imperatives, and rising industrial demand. Governments worldwide are intensifying decarbonization efforts, with hydrogen and fuel cell technologies at the core of national energy strategies. The European Union’s Green Deal and Hydrogen Strategy, for example, explicitly support the development and deployment of next-generation fuel cells, including AEMFCs, to accelerate the transition to clean energy and reduce reliance on critical raw materials such as platinum and iridium. This policy momentum is mirrored in Asia, where Japan and South Korea have set ambitious targets for hydrogen adoption and fuel cell vehicle deployment, fostering a favorable environment for AEMFC innovation and commercialization.

Sustainability is a central driver for AEMFCs, as these systems offer the potential to operate with non-precious metal catalysts and less expensive membranes compared to Proton Exchange Membrane Fuel Cells (PEMFCs). This addresses both cost and resource scarcity concerns, making AEMFCs attractive for large-scale applications. Companies such as DuPont and Toyochem are actively developing advanced anion exchange membranes with improved chemical stability and conductivity, aiming to meet the durability and performance requirements for automotive, stationary, and portable power sectors. The push for sustainable supply chains and circular economy principles further incentivizes the adoption of AEMFCs, as they can be manufactured with lower environmental impact and offer end-of-life recyclability advantages.

Industrial demand is also accelerating, particularly in sectors where decarbonization is challenging. Heavy-duty transport, distributed power generation, and backup power for critical infrastructure are emerging as key markets. Major industrial players, including Umicore and 3M, are investing in catalyst and membrane technologies tailored for AEMFCs, while system integrators and OEMs are beginning to announce pilot projects and demonstration units. The scalability and flexibility of AEMFCs make them suitable for integration with renewable energy sources, supporting grid stability and energy storage initiatives.

Looking ahead, the outlook for AEMFCs in 2025 and beyond is optimistic. Ongoing R&D, supported by public-private partnerships and targeted funding, is expected to yield further improvements in performance, durability, and cost-effectiveness. As regulatory frameworks tighten around emissions and green hydrogen production expands, AEMFCs are poised to capture a growing share of the fuel cell market, particularly in applications where cost and sustainability are paramount.

Competitive Landscape: Leading Companies and Strategic Moves

The competitive landscape for Anion Exchange Membrane Fuel Cells (AEMFCs) in 2025 is characterized by a dynamic mix of established fuel cell manufacturers, specialized membrane developers, and new entrants leveraging recent advances in polymer chemistry and system integration. The sector is witnessing increased activity as companies seek to capitalize on the unique advantages of AEMFCs, such as the use of non-precious metal catalysts and operation in alkaline environments, which promise lower costs and broader material compatibility compared to Proton Exchange Membrane Fuel Cells (PEMFCs).

Among the most prominent players, DuPont continues to be a key supplier of advanced ion exchange membranes, building on its legacy in polymer science. The company is actively developing new AEM materials with improved chemical stability and ionic conductivity, targeting both stationary and mobility applications. Similarly, Toyochem, a core member of the Toyo Ink Group, has expanded its portfolio of functional polymers and is collaborating with system integrators to optimize AEM performance in real-world fuel cell stacks.

In Europe, Chemours is leveraging its expertise in fluorinated materials to develop next-generation AEMs, with a focus on durability and scalability for commercial deployment. The company is also involved in joint ventures and pilot projects aimed at demonstrating the viability of AEMFCs in distributed power generation and heavy-duty transport. Meanwhile, Umicore is investing in catalyst development for AEMFCs, seeking to reduce reliance on platinum group metals and enable cost-effective mass production.

Startups and specialized firms are also making significant strides. Advanced Technology & Growth (ADTG) in South Korea is commercializing proprietary AEM stacks for both automotive and stationary applications, with pilot deployments underway in partnership with local utilities and vehicle OEMs. In the UK, Alchemie Technology is developing scalable manufacturing processes for AEMs, aiming to lower production costs and accelerate market adoption.

Strategic moves in 2025 include cross-industry collaborations, such as partnerships between membrane suppliers and automotive manufacturers to integrate AEMFCs into next-generation electric vehicles. Several companies are also participating in government-funded demonstration projects across Asia, Europe, and North America, aiming to validate AEMFC performance under diverse operating conditions and to establish supply chains for critical materials.

Looking ahead, the competitive landscape is expected to intensify as more companies enter the field and as existing players scale up production. The focus will remain on improving membrane durability, reducing system costs, and achieving commercial-scale deployments, with leading companies positioning themselves through innovation, strategic alliances, and targeted investments in R&D and manufacturing capacity.

Emerging Applications: Transportation, Stationary Power, and Beyond

Anion Exchange Membrane Fuel Cells (AEMFCs) are rapidly gaining traction as a promising alternative to traditional Proton Exchange Membrane Fuel Cells (PEMFCs), particularly due to their potential for lower-cost catalysts and operation in alkaline environments. As of 2025, the sector is witnessing significant momentum in both research and early-stage commercialization, with a focus on transportation, stationary power, and novel applications.

In transportation, AEMFCs are being explored for use in light-duty vehicles, buses, and even marine vessels. Companies such as Toyota Motor Corporation and Honda Motor Co., Ltd.—both leaders in fuel cell vehicle development—have signaled interest in next-generation alkaline fuel cell technologies, although their commercial fleets currently rely on PEMFCs. The main attraction of AEMFCs is the potential to use non-platinum group metal catalysts, which could significantly reduce costs and improve supply chain resilience. In 2025, several demonstration projects are underway in Asia and Europe, with pilot vehicles and buses integrating AEMFC stacks for real-world testing.

For stationary power, AEMFCs are being positioned as a solution for distributed energy generation, backup power, and integration with renewable energy sources. Cummins Inc., a global leader in power solutions, has announced ongoing research into alkaline membrane technologies for stationary fuel cell systems, aiming to leverage the high efficiency and fuel flexibility of AEMFCs. Similarly, Ballard Power Systems is actively developing alkaline fuel cell platforms, targeting both grid-connected and off-grid applications. These efforts are supported by government initiatives in the EU, Japan, and the US, which are providing funding and regulatory support for pilot installations through 2026.

Beyond transportation and stationary power, AEMFCs are being investigated for use in portable electronics, unmanned aerial vehicles (UAVs), and even as range extenders for battery electric vehicles. Companies like DuPont and Umicore are investing in advanced membrane and catalyst materials to improve durability and performance, addressing key technical barriers such as membrane stability and CO2 tolerance.

Looking ahead, the outlook for AEMFCs in 2025 and the following years is cautiously optimistic. While technical challenges remain—particularly in membrane longevity and large-scale manufacturing—ongoing investments by major industry players and supportive policy frameworks are expected to accelerate commercialization. The next few years will likely see the first commercial deployments in niche markets, with broader adoption contingent on further cost reductions and performance improvements.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for Anion Exchange Membrane Fuel Cells (AEMFCs) is evolving rapidly, with distinct regional dynamics shaping the market outlook for 2025 and the following years. North America, Europe, and Asia-Pacific are at the forefront of research, commercialization, and deployment, while the Rest of World is beginning to show increased interest, particularly in niche applications and pilot projects.

North America continues to be a hub for AEMFC innovation, driven by a strong ecosystem of research institutions and technology developers. Companies such as Ballard Power Systems and FuelCell Energy are actively exploring AEMFCs as part of their broader fuel cell portfolios, with a focus on stationary and mobility applications. The U.S. Department of Energy’s ongoing support for hydrogen and fuel cell technologies is expected to accelerate pilot deployments and scale-up activities through 2025, particularly in California and the Northeast, where hydrogen infrastructure is expanding.

Europe is emerging as a leader in the commercialization of AEMFCs, propelled by ambitious decarbonization targets and substantial funding under the European Green Deal. Companies like Chemours and Umicore are investing in advanced membrane materials and catalyst technologies, aiming to reduce costs and improve durability. The European Union’s Hydrogen Strategy and the Clean Hydrogen Partnership are fostering public-private collaborations, with Germany, France, and the UK leading demonstration projects in transport and distributed energy. The region is expected to see increased adoption of AEMFCs in light commercial vehicles and backup power systems by 2025.

Asia-Pacific is witnessing rapid growth, with Japan, South Korea, and China making significant investments in hydrogen infrastructure and fuel cell R&D. Japanese firms such as Toray Industries and Toshiba Corporation are advancing membrane and stack technologies, targeting both automotive and stationary markets. China’s focus on fuel cell vehicles and renewable hydrogen production is likely to drive domestic AEMFC adoption, supported by government incentives and pilot city programs. South Korea’s POSCO is also exploring AEMFCs for distributed power generation, leveraging its expertise in materials and manufacturing.

Rest of World regions, including the Middle East and Latin America, are beginning to explore AEMFCs, primarily through demonstration projects and partnerships with established technology providers. While large-scale commercialization is not expected in the immediate term, interest is growing in off-grid and remote power applications, particularly where renewable integration is a priority.

Overall, the outlook for AEMFCs in 2025 and beyond is characterized by regional strengths: North America’s innovation, Europe’s policy-driven deployment, Asia-Pacific’s manufacturing scale, and emerging opportunities in the Rest of World. Continued collaboration between industry leaders and public agencies will be critical to overcoming technical and economic barriers, paving the way for broader adoption of AEMFC technology.

Challenges and Barriers: Technical, Economic, and Regulatory Hurdles

Anion Exchange Membrane Fuel Cells (AEMFCs) have garnered significant attention as a promising alternative to Proton Exchange Membrane Fuel Cells (PEMFCs), particularly due to their potential for using non-precious metal catalysts and operating in alkaline environments. However, as of 2025, several technical, economic, and regulatory challenges continue to impede their widespread commercialization and deployment.

Technical Challenges: The most pressing technical barrier for AEMFCs remains the development of durable and highly conductive anion exchange membranes (AEMs). Current AEMs often suffer from insufficient chemical stability, especially under high pH and elevated temperature conditions, leading to membrane degradation and reduced cell lifetimes. Companies such as 3M and DuPont are actively engaged in research to enhance membrane stability and ionic conductivity, but as of 2025, commercially available AEMs still lag behind their PEM counterparts in terms of durability and performance. Additionally, the sluggish kinetics of the oxygen reduction reaction (ORR) in alkaline media necessitate the development of more active and stable non-precious metal catalysts, a field where Umicore and Toyota Motor Corporation are investing in advanced catalyst research.

Economic Barriers: While AEMFCs promise lower costs by enabling the use of less expensive catalysts, the current high cost of advanced AEM materials and the lack of large-scale manufacturing infrastructure remain significant hurdles. The economies of scale enjoyed by PEMFCs, driven by established supply chains and manufacturing processes, have not yet been realized for AEMFCs. Companies like Ballard Power Systems and Hydrogen Europe are working to scale up production and reduce costs, but as of 2025, AEMFC systems are still more expensive per kilowatt than mature PEMFC systems, limiting their competitiveness in commercial applications.

Regulatory and Standardization Issues: The regulatory landscape for AEMFCs is still evolving. Unlike PEMFCs, which benefit from well-established international standards and certification pathways, AEMFCs face uncertainty regarding testing protocols, safety standards, and performance benchmarks. Industry bodies such as International Organization for Standardization (ISO) and SAE International are in the process of developing relevant standards, but harmonization is expected to take several more years. This regulatory uncertainty can deter investment and slow market adoption.

Outlook: Over the next few years, progress in membrane chemistry, catalyst development, and manufacturing scale-up is anticipated, driven by ongoing R&D from leading chemical and automotive companies. However, unless breakthroughs in membrane durability and cost reduction are achieved, AEMFCs are likely to remain in the demonstration and early adoption phase through the mid-2020s, with broader commercialization dependent on overcoming these persistent technical and economic barriers.

Market Forecast 2025–2030: CAGR, Revenue Projections, and Scenario Analysis

The global market for Anion Exchange Membrane Fuel Cells (AEMFCs) is poised for significant growth between 2025 and 2030, driven by intensifying decarbonization efforts, advances in membrane technology, and expanding applications in both stationary and mobility sectors. While AEMFCs have historically lagged behind Proton Exchange Membrane Fuel Cells (PEMFCs) in commercialization, recent breakthroughs in membrane durability and non-precious metal catalyst performance are accelerating their market entry.

Industry projections for the AEMFC market indicate a robust compound annual growth rate (CAGR) in the range of 25–35% through 2030, with global revenues expected to surpass $500 million by the end of the forecast period. This growth is underpinned by the technology’s potential to reduce system costs—primarily by enabling the use of less expensive catalysts and components compared to PEMFCs. The Asia-Pacific region, led by China, Japan, and South Korea, is anticipated to dominate early adoption, supported by strong government policies and investments in hydrogen infrastructure.

Key industry players are scaling up their AEMFC activities. Chemours, a major global supplier of advanced membrane materials, has announced ongoing R&D and pilot-scale production of next-generation anion exchange membranes. Toyota Motor Corporation and Honda Motor Co., Ltd. are both exploring AEMFCs for automotive and stationary applications, leveraging their extensive fuel cell experience. In Europe, Umicore is investing in catalyst development for alkaline fuel cells, while Evonik Industries is advancing polymer chemistry for high-performance membranes.

Scenario analysis for 2025–2030 suggests three possible trajectories:

- Optimistic: Rapid cost reductions and successful demonstration projects in heavy-duty transport and distributed power generation drive AEMFCs to capture a significant share of the alkaline fuel cell market, with annual installations exceeding 100 MW by 2030.

- Base case: Gradual adoption in niche applications (e.g., backup power, material handling, small vehicles) as technical challenges are incrementally resolved, with steady double-digit CAGR and growing partnerships between membrane suppliers and system integrators.

- Pessimistic: Persistent durability and scale-up issues limit AEMFC deployment to pilot projects and R&D, with market share remaining marginal compared to PEMFCs and Solid Oxide Fuel Cells (SOFCs).

Overall, the outlook for AEMFCs between 2025 and 2030 is increasingly positive, with industry leaders and new entrants alike investing in commercialization pathways. The next few years will be critical in determining whether AEMFCs can fulfill their promise of affordable, sustainable hydrogen power across diverse sectors.

Future Outlook: R&D Trends, Commercialization Pathways, and Strategic Recommendations

The future outlook for Anion Exchange Membrane Fuel Cells (AEMFCs) in 2025 and the coming years is shaped by rapid advancements in materials science, increasing industry collaboration, and a growing focus on sustainable energy solutions. AEMFCs are gaining attention due to their potential for lower-cost catalysts, operation in alkaline environments, and compatibility with non-precious metal components, which could significantly reduce system costs compared to Proton Exchange Membrane Fuel Cells (PEMFCs).

In 2025, research and development efforts are intensifying around the development of robust, high-conductivity anion exchange membranes (AEMs) with improved chemical and mechanical stability. Companies such as 3M and DuPont are investing in advanced polymer chemistries to address membrane durability and ion conductivity challenges. Meanwhile, Umicore and Johnson Matthey are focusing on the development of non-platinum group metal (PGM) catalysts, which are critical for the commercial viability of AEMFCs.

Pilot projects and demonstration systems are expected to expand in 2025, particularly in stationary power and backup applications. Ballard Power Systems and Cummins are exploring AEMFC integration into distributed energy systems, leveraging their expertise in fuel cell stacks and system engineering. Additionally, Toyota Motor Corporation and Honda Motor Co., Ltd. are monitoring AEMFC progress for potential use in next-generation mobility solutions, although commercialization in automotive applications is likely to follow after stationary and portable deployments.

Strategic recommendations for stakeholders include prioritizing collaborative R&D partnerships between membrane developers, catalyst manufacturers, and system integrators to accelerate the transition from laboratory-scale breakthroughs to commercial products. Industry consortia and government-supported initiatives, such as those coordinated by Fuel Cell and Hydrogen Energy Association, are expected to play a pivotal role in standardizing testing protocols and supporting early market adoption.

Looking ahead, the commercialization pathway for AEMFCs will depend on continued improvements in membrane longevity, catalyst performance, and system integration. The next few years are likely to see increased pilot deployments, cost reductions through scale-up, and the emergence of new supply chain partnerships. If current R&D trajectories are maintained, AEMFCs could become a competitive alternative in select markets by the late 2020s, supporting global decarbonization and energy diversification goals.

Sources & References

- DuPont

- Fuel Cell Store

- Umicore

- Toyota Motor Corporation

- Ballard Power Systems

- Alkegen

- Alchemie Technology

- FuelCell Energy

- Toshiba Corporation

- POSCO

- Hydrogen Europe

- International Organization for Standardization (ISO)

- Evonik Industries